If the ATO classes the area you live and work in as remote, you could enjoy additional tax savings with salary packaging.

The savings you could make will vary depending on your location, your employer and the industry you work in.

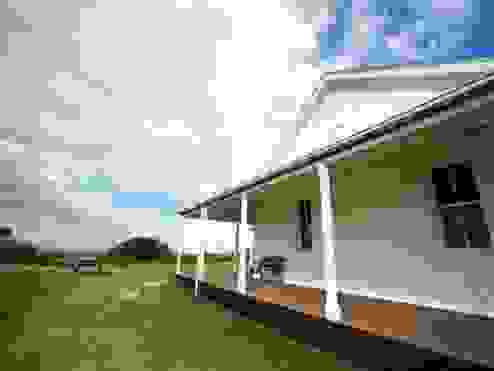

If your primary residence is in a remote area, you could salary package the interest part of your mortgage repayments, plus your gas and electricity bills.

This could save you thousands as using your pre-tax dollars to pay these expenses means you pay less tax.

If you are in rented accommodation, you could salary package your rental costs. Just like a mortgaged property, you can also salary package the gas and electricity bills too.

If you are leasing the property, the lease agreement must be in your name, and you need to be 100% responsible for the cost. You can also salary package the cost, if your employer owns or leases a property for you.

If you’re purchasing a property in a remote location or have bought land to build a home as your primary residence, you can salary package the associated costs.

If you live in a remote location and are travelling for a holiday, you may be able to salary package your travel expenses to the nearest capital city.

Your holiday must be for at least three working days, and you travel by commercial transport (i.e. flight, bus, train or ferry).

.

Your eligibility will depend on your employer’s salary packaging policy and your employment status. Check with your employer to see if this benefit is available to you.

.

Disclaimers:

Important: This is general information only. Before entering a salary packaging or novated leasing arrangement, you should consider your objectives, financial situation and needs, and seek appropriate legal, financial or other professional advice based upon your own particular circumstances. The availability of benefits is determined by your employer. Conditions and fees apply.

The ATO website lists ‘remote area’ towns. Visit https://www.ato.gov.au/Business/Fringe-benefits-tax/In-detail/Fringe-benefits-tax---remote-areas/ to see if your area qualifies as ‘remote’ or ask your employer. Like all salary packaged items, you can’t claim an income tax deduction on packaged remote area expenses. Smartsalary is unable to make your rent, mortgage interest, or utility payments on your behalf – salary packaged amounts will be reimbursed to your nominated bank account.