Public Education

Get smart with your salary by paying for certain items before tax, to increase your take-home pay.

Get smart with your salary by paying for certain items before tax, to increase your take-home pay.

Whether you work as a teacher, admin or other support staff in a public school, you may be eligible to salary package a number of everyday items. So, instead of paying for these items with your salary after it's been taxed, you pay for them with your pre-tax salary. This means you could pay less tax, and you take home more of your pay.

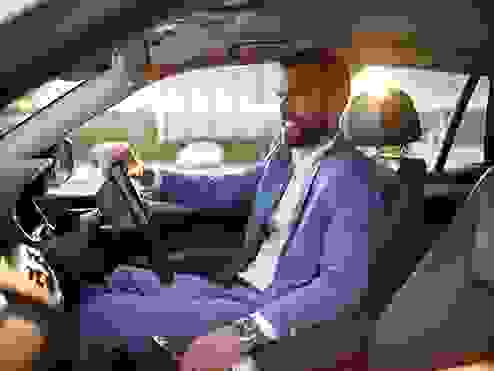

Car leasing (also known as novated leasing) is one of the simplest and most cost-effective ways to buy and run a car. Over the lifetime of your lease you could save thousands.

If you use your laptop mainly for work purposes you may be eligible to salary package the cost – and save up to 45% on the purchase price.1

When you salary sacrifice extra superannuation contributions, you could save on tax while building your future wealth.

If you use a financial planner or a tax advisor, you could salary package the fees and save.

There are lots of items you can package to help you save on work-related expenses.

Studying so that you can get ahead in your job? Salary package the costs and you could save.

If you have income protection insurance, you may qualify to package this benefit.

Whether you travel for work or personal reasons you can salary package your airline lounge membership.

If you have an investment loan you could package the cost and save.

In addition to the salary packaging savings available to you, as a Smartsalary customer, you can also access a great range of rewards.

Important information:

This is general information only. Before entering into any salary packaging or novated leasing arrangement, you should consider your objectives, financial situation and needs, and, seek appropriate legal, financial or other professional advice based upon your own particular circumstances. The availability of benefits is determined by your employer. Conditions and fees apply.

1 A portable electronic device can only be salary packaged if it is used primarily (over 50%) for work purposes. Tax savings achieved through salary packaging will depend on your income tax bracket and personal circumstances.

2 Savings example is for illustrative purposes only, and is based on the income tax rates for the 2024/25 financial year. Your actual savings will depend on your income tax bracket, the GST processing method nominated by your employer, administration fees payable under your employer’s salary packaging plan and your personal circumstances.

3 Based on the following assumptions: living in NSW 2560, salary: $70,000 gross p.a., travelling 15,000 kms p.a., lease term: 60 months, using Net GST processing method and Employee Contribution Method for FBT purposes. Images shown may not be the exact car that the calculations have been based on. All figures quoted include budgets for finance, fuel, servicing, tyres, maintenance, Vero by Suncorp comprehensive motor insurance and re-registration over the period of the lease. Your actual savings will depend on your income tax bracket, the GST processing method nominated by your employer, administration fees payable under your employer’s salary packaging plan, the negotiated Smartleasing discount on your chosen vehicle and your personal circumstances. Vehicle residual, as set by Australian Taxation Office, payable at the end of lease term. The exact residual amount will be specified in your vehicle quote. Vehicle pricing is correct at July 2024 but may be subject to change based on availability.