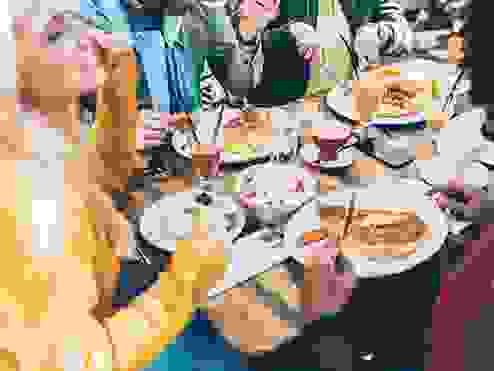

Meal Entertainment Packaging

Salary packaging your restaurant meals is a simple way to put tax savings on the menu

Salary packaging your restaurant meals is a simple way to put tax savings on the menu

Have you got an appetite for savings? If the answer is yes, by salary packaging meal entertainment benefits, you could enjoy a tasty side of tax-free savings when you dine out with family or friends. Salary package up to $2,650 of meal entertainment expenses and you could save hundreds of dollars each Fringe Benefits Tax (FBT) year (1 April - 31 March).1

Dining at a restaurant, café, club, pub or fast food restaurant with your family or friends

Hiring professional caterers to prepare and serve food and drinks for a party.2

Attending a ball, gala event or charity dinner

Salary packaging your next restaurant or café meal is easy by using the Smartsalary Salary Packaging and Meal Entertainment card. It's a Mastercard® loaded with your pre-tax dollars that you can use for dining out.

Disclaimers:

Important: This is general information only. Before entering into any salary packaging or novated leasing arrangement, employees should consider their objectives, financial situation and needs, and seek appropriate legal, financial or other professional advice based upon their own particular circumstances. The availability of benefits is determined by the employer. Conditions and fees apply.

Important information:

This is general information only. Before entering into any salary packaging or novated leasing arrangement, you should consider your objectives, financial situation and needs, and, seek appropriate legal, financial or other professional advice based upon your own particular circumstances. The availability of benefits is determined by your employer. Conditions and fees apply.

1 There’s a cap across Meal and Entertainment, Holiday Accommodation and Venue Hire benefits of $2,650 per FBT year (1 April –31 March). Eligibility for the Holiday Accommodation and Venue Hire benefit is dependent on your industry and employer.

2 Subject to your employer’s policy.