Salary Packaging Superannuation

Salary Packaging (also known as salary sacrifice) your additional superannuation contributions to increase your future wealth

Salary Packaging (also known as salary sacrifice) your additional superannuation contributions to increase your future wealth

Superannuation isn’t just for retirement – it’s an important consideration at every stage of life - whether you are saving for your first home, or looking to boost your superannuation balance.

It just got easier with the First Home Super Saver Scheme. You could boost your savings by at least 30% by building a deposit for your first home inside a lower-taxed superannuation fund environment.1

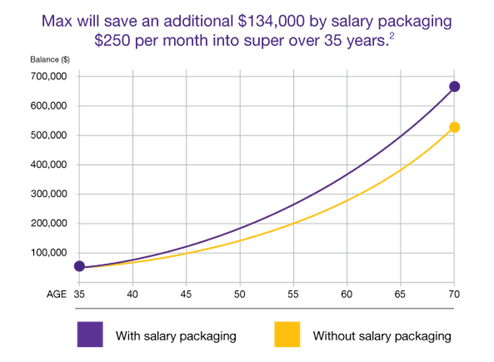

The key to a solid superannuation balance is time – the sooner you start, the more you will save. And because you are paying a lower tax rate on salary packaged contributions, more money could go towards your actual retirement savings.

Check out this savings example to see the difference a small contribution could make.2

Do you have enough in your superannuation to live the

life you imagine in retirement? You can continue salary packaging into your superannuation until you’re 75, which could allow you to pay a much lower rate of tax and could help you maximise your savings.

Your eligibility is dependent on your employer's salary packaging policy and your employment status. Use our salary packaging calculator to see which benefits you can package and how much you could save.

Important information:

This is general information only. Before entering into any salary packaging or novated leasing arrangement, you should consider your objectives, financial situation and needs, and, seek appropriate legal, financial or other professional advice based upon your own particular circumstances. The availability of benefits is determined by your employer. Conditions and fees apply.

1. For most people, the First Home Super Saver Scheme could boost the savings they can put towards a deposit by at least 30% compared with saving through a standard deposit account (this is due to the concessional tax treatment and the higher rate of earnings within superannuation). Information obtained from https://archive.budget.gov.au/2017-18/glossies/factsheets/FS_14_Housing_Affordability.pdf. You can apply to have a maximum of $15,000 of your voluntary contributions from any one financial year included in your eligible contributions to be released under the FHSS scheme, up to a total of $30,000 contributions across all years. Eligibility requirements apply. See ATO website for details.

2. Calculated July 2024 using the superannuation calculator at https://moneysmart.gov.au/how-super-works/superannuation-calculator. This is a model based on the following assumptions: age 35 years, super balance $55,000, annual salary $80,000, salary packaging additional super contributions of $250/month over 35 years. The results are based on limited information and assumptions made about the future. The amounts projected are estimates only are not guaranteed. See a full list of disclaimers and assumptions on the Money Smart website.